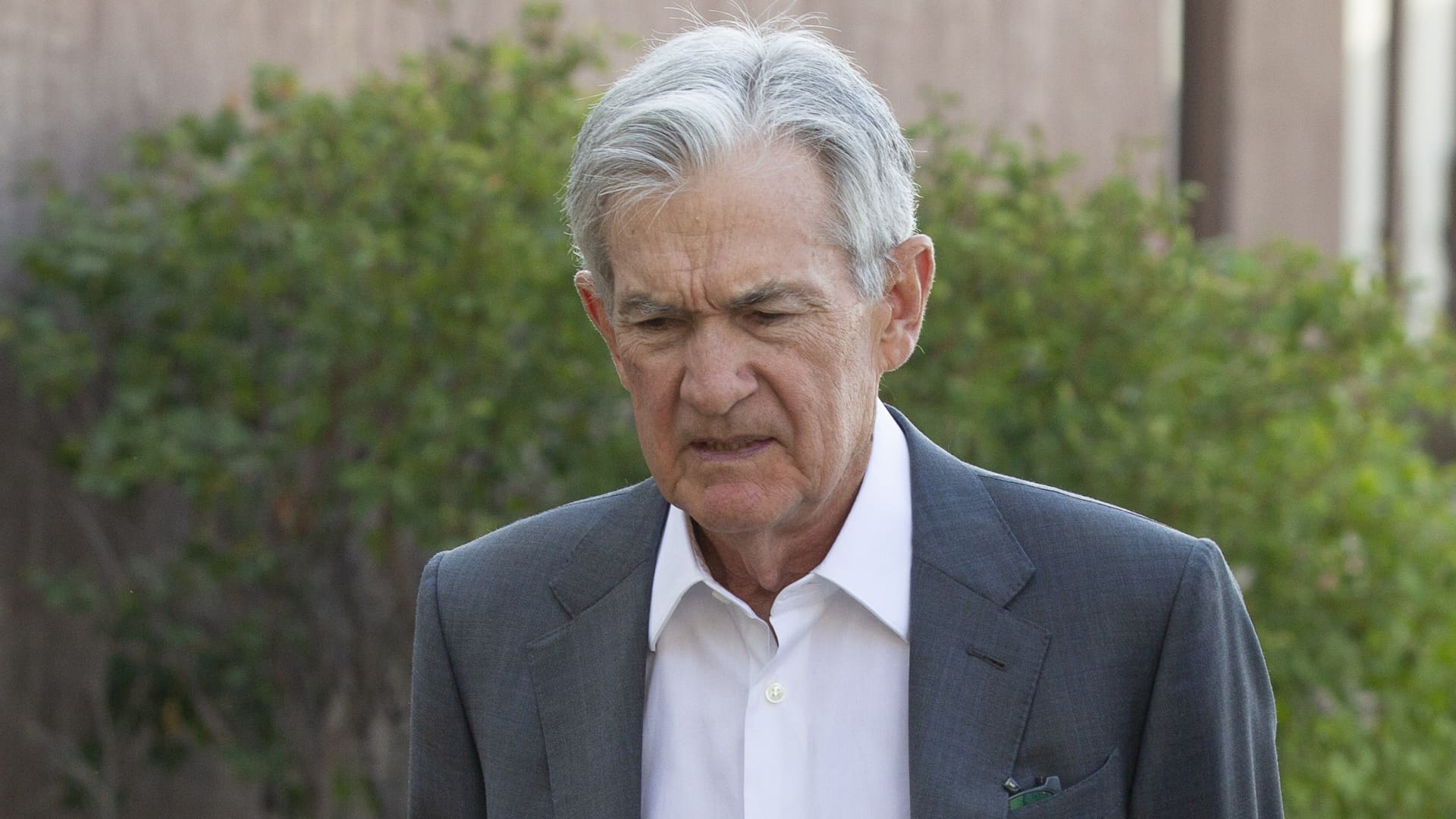

Friday’s booming rally turned into Monday’s reality check as investors weighed just how aggressive the Federal Reserve will be on lowering interest rates and how the moves might impact the broader business and economic climate. Chair Jerome Powell, in his annual address at the Jackson Hole, Wyoming, symposium, gave Wall Street hope of easier days ahead when he said conditions “may warrant adjusting our policy stance,” which is generally seen as “Fedspeak” for cutting rates. …

There’s worry retail investor exuberance in the exchange-traded fund space is flashing a warning signal for markets. As individuals pour billions of dollars into some of the riskiest pockets of the exchange-traded fund market, some experts like ETF Action’s Mike Akins question whether the trend is a sign of markets overheating. “Product proliferation in the ETF market is at its all-time high right now,” the firm’s founding partner told CNBC’s “ETF Edge” this week. “We …

Current and former Federal Reserve officials struck a common note when asked about Lisa Cook’s situation: It’s imperative the central bank’s independence is preserved. Cook, a Fed governor nominated in 2022 by then-President Joe Biden, has faced attacks over accusations of mortgage fraud from Federal Housing Finance Agency Director Bill Pulte. Justice Department attorney Ed Martin also urged Chair Jerome Powell to fire Cook from her post and confirmed a criminal investigation will take place. …

Cleveland Federal Reserve President Beth Hammack said Friday she would be hesitant about lowering interest rates as long as inflation remains a threat. In a CNBC interview, the policymaker did not share the market’s enthusiasm for a cut, sparked after Chair Jerome Powell’s keynote speech earlier in the morning stating that current conditions “may warrant” policy easing. “I heard I heard that the chair is open minded about what the right stance of policy is …

[The stream is slated to start at 10 a.m. ET. CNBC Television will start the stream when the event begins. Please refresh the page if you do not see a player above.] Federal Reserve Chair Jerome Powell delivers his annual address Friday morning at the central bank’s annual symposium in Jackson Hole, Wyoming. With the speech expected to review the economic situation and the Fed’s five-year framework outlook, markets also are looking to Powell to …

Federal Reserve Chair Jerome Powell on Friday gave a tepid indication of possible interest rate cuts ahead as he noted a high level of uncertainty that is making the job difficult for monetary policymakers. In his much-anticipated speech at the Fed’s annual conclave in Jackson Hole, Wyoming, the central bank leader in prepared remarks cited “sweeping changes” in tax, trade and immigration policies. The result is that “the balance of risks appear to be shifting” …

Wage growth is doing something odd these days. Typically, wages grow at a faster clip each year for workers who switch jobs, compared to those who stay in their current role. That makes sense: Workers generally leave a job when they find something better for them, which often includes a higher salary, according to labor economists. But in 2025, the roles have reversed as workers, faced with a souring job market, shift from job-hopping to …

Walmart‘s former U.S. CEO Bill Simon thinks Thursday’s stock drop is bizarre. The big-box retailer lifted its full-year sales and earnings forecast, but the stock still slid 4.5%. Walmart ended Thursday as the Dow’s biggest loser. “It was about as good of a quarter as any retailer could have in any environment,” he said on CNBC’s “Fast Money.” “I don’t get the decline in the market today at all.” Simon, who ran Walmart U.S. from …

BEIJING — Household robots for cleaning are about to quickly become an affordable reality. At least that’s what Quan Gang, president of Beijing-based robot vacuum cleaner company Roborock, has in mind as he strategizes for the next five years. The company ranks first among smart vacuums by global market share, according to IDC Research. Last week, it reported a nearly 79% revenue surge in the first half of this year. About half of sales came …

Federal Reserve Chair Jerome Powell is set to deliver what almost certainly will be his last keynote address at the central bank’s annual conclave during one of the most tumultuous times in its history. What’s at stake is the near-term sentiment for financial markets, the longer-term path of the Fed’s policy trajectory, and a not insignificant dose of trying to preserve vestiges of independence at a time when the normally sacrosanct institution is facing enormous …